This was a mistake on my part, because there isn't really the ability on Facebook to get down to economic evidence and reasoning. I got the usual kind of Facebook shout-fest for my troubles. I should have known better.

Still, as an educator, this is a teachable moment, and so I can't just abandon the field. I chose instead to put my views in writing here on my blog, where I can show proper graphics and explain myself at length. Arguably, this is a retreat. But I don't care to play the game the way it's normally played, with people yelling at one another in short, rude, Facebook blurbs and tweets, so here goes.

The reason I don't believe that the current US deficit and national debt are that important in the large scheme of things is because the absolute value of a deficit is not the proper economic measure to use when evaluating whether or not it can be easily repaid. Instead, we have to use a relative value. The debt has to be compared to national income and to the prevailing rate of interest.

Indeed, this is what will happen if a consumer applies for a mortgage or a car loan. It doesn't matter whether it's a second-hand Chevy Aveo or a nice new BMW, the bank will only make the loan if the individual's debt to income ratio meets certain income parameters. In deciding the threshold, they take the interest rate into account.

In the case of the current (annual) US deficit and (total) national debt, both are actually at surprisingly moderate levels, compared to the now-growing US GDP. Here's the relevant graphics, starting with the national debt:

Click on the graphic to enlarge it. This chart was first published in The Atlantic late last year, to accompany a nice, solid article on the debt by Matthew Philips. Both the article and the chart paint a different story than you'll get from listening to politicians. I recommend you read it, especially before responding to this post. Basically, the baby-boomers inherited a much larger debt, proportional to their ability to pay, than the current older generation is leaving the young.

You can see from the graph that at around 63%, the current dept/GDP ratio is high, the second highest ever, but only about 15% points above the Reagan-era figure. Reagan's debt went mostly to pay for US military expansion, which boosted the economy, creating what a lot of progressive economists call, tongue-in-cheek, "militarized Keynesianism." (Allegedly, the only kind of economic stimulus Republicans like, but a stimulus nevertheless, whose employment proves the point that Keynesian fiscal stimulus does work.)

We began to pay that particular used car off quite nicely once growth and more moderate government took over again in the 1990s. Low oil prices and the dot com boom helped.

And the bank, which in this case means the international bond holders that hold US government debt, believes that the whole thing is quite a decent investment, and rewards us with historically low interest rates on these bonds, lower indeed than the Reagan era ones.

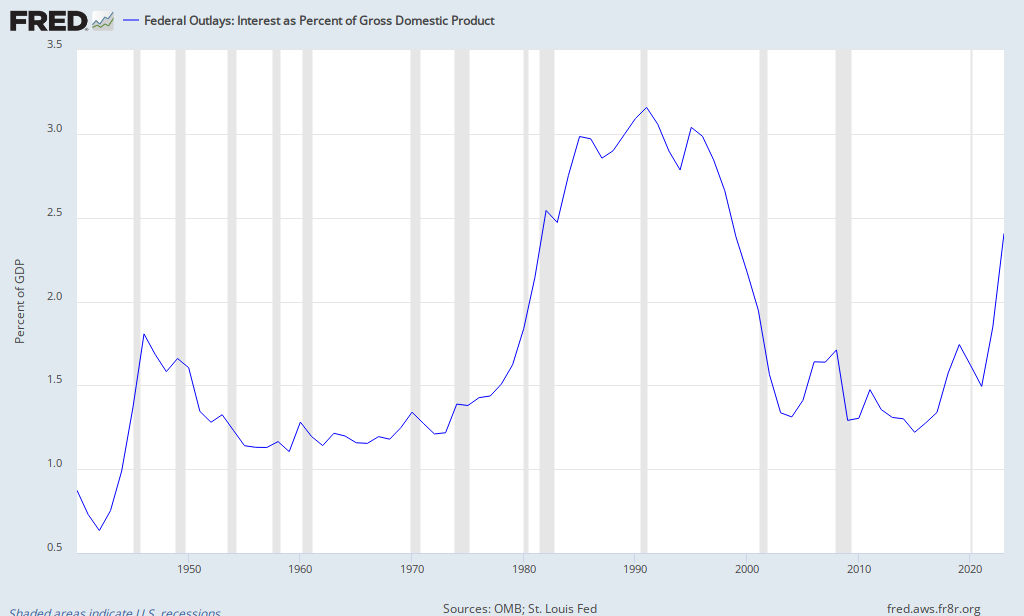

In other words, global capitalists aren't at all worried about the deficit. If they were, interest rates on US bonds would rise. But they are at the lowest levels in a generation. Here's the relevant data, again total interest outlay is showed proportional to GDP:

What this means is that we should have been several times more worried about the deficit in the Reagan era than we are now. Instead the opposite is more likely true for most young people, given all the misinformation circulating about the debt right now.

As for the current account deficit to GDP ratio, that has been improving nicely since the end of the most recent significant round of fiscal stimulus, the ARRA, in 2011. In the graph below, a balanced budget is represented by the zero line, a deficit is a negative value, and a surplus a positive value. The uptick at the end is our current improving situation.

You can also see that the US had a deficit nearly every year since 1948. How could we afford this? Well, because GDP growth and inflation essentially made the deficit affordable. And, although the recent deficits have been large, at least since WWII, we are again reducing them quite nicely.

Who is actually paying down the current account deficit? Well, other than GDP growth, which is actually the major part of the decrease, those of us who have had our taxes raised recently are paying it down, especially older people who have career jobs that pay relatively well, and those of us who are receiving fewer services since the recent sequester. I'm no billionaire, but I'm now paying over a hundred dollars a month more in federal taxes than I was three months ago. And the recent announcement that some of the tourist roads in Acadia NP will open later than usual because of the sequester is just one example of where the savings are coming from. This will, of course, be the second major US debt boom that I've helped pay off, the first being the one in the 1990s.

This is essentially what happens if a young couple buys a house on a typical 20-30 year fixed-interest mortgage and lives in it thriftily for the rest of their lives. The payments will seem high at the beginning. But by the end of the process, inflation and income growth will have reduced their importance in the family budget. By the time the mortgage is paid off, years ahead of time, it won't even be a very big bill in the general scheme of things. If at the same time, they reduce other bills, they might even make double payments on the mortgage.

And so, if the national-level process follows the established pattern since 1945, the deficit will be reduced to a manageable negative three to five percent within a few years here, perhaps sooner, while the debt itself will go away over a longer period of time, although never completely. The total debt level is in fact not that important once the correct deficit to GDP ratio is reestablished. And most of this will be achieved by the new tax hikes and spending cuts already in the pipeline, which don't really make a big difference to younger people at the beginning of their careers, unless they are already making large salaries.

Hence, by the way, Speaker of the House Beohner's recent confession on national TV that the palaver over the debt and deficit is just that, palaver.

None of this rational argument is going to make a big dint in the pessimism of a member of the younger generation who has fallen victim to the recent, mostly right-wing propaganda about the debt and deficit. I'm getting too long in the tooth to expect that propaganda goes away just because some professor proves it bull with a few statistics. The viral meme is just too strong. But I expect that the fuss will die down over the next few years, as fussing about the debt drops off the national radar a little at a time.

What was interesting about my Facebook exchange was that this particular alumnus's pessimism was compounded by the addition of climate change to his Calculus of Doom. This is of course not usually a concern for the right wing in US politics. But I can see how someone might be lured into seeing them as part and parcel of the same rigged scheme, youth versus age.

Essentially, in this view, the older generation is sticking the younger one with both a large un-payable debt and a deteriorating climate.

OK. Now there's one point there I can at least in part agree with. If we don't do something rational about climate change soon, we will have stuck the younger generation with a terrible burden.

But what's the solution? And what is the relationship of the solution to the federal debt and to Keynesian economics?

There are essentially two economic roads out of the climate crisis. One is to adopt a strong ecological economics prescription of low or zero growth, a Dalian steady-state economy.

The other is to grow a green energy economy, which would also grow GDP, to essentially continue on the current pathway of growth economics, only to replace dirty energy sources with green ones.

Certainly we're in trouble with the deficit if we adopt a zero growth plan. Without GDP growth, the deficit and debt will remain large in comparison to GDP, and would be very hard to pay off. A low or zero growth plan will also require unimaginably large programs of social reeducation (to reduce the power of consumerism) and a huge reevaluation of the idea of work in American society (the small amount of remaining work would have to be much more equally shared out) if it isn't going to look and feel like a horrible depression.

But we're almost certainly not going to choose this option anyway.

Particularly given the most recent political climate in the US, the same political climate that produced the deficit propaganda this former student is swallowing, I don't for a minute imagine that American society is ready to give up on growth economics and reevaluate consumerism and employment as foundations for society. That's just too much to ask.

This plan would also require an almost impossible level of public education regarding the dangers of climate change and other sustainability problems, as well as complete revision of the American mythology about capitalism. It just isn't very likely to happen anytime soon.

Even though I studied under Daly, and even though I think ecological economics is a great scientific improvement over neo-classical and even Keynesian economics, and even though I would like to see the world begin to move towards acceptance of the steady-state reasoning that you can't grow an economy forever on a finite planet, I understand that explaining this notion to the American people right now is going to be very, very difficult to do.

But I don't think that business-as-usual capitalism is a safe pathway, either. That will almost certainly result in the kind of damage ot the climate and to planetary ecosystems that this alumus is worried about.

What I think might succeed in the current political environment is a kind of green Keynesianism, whereby we learn to invest in renewable energy not just as the solution to climate change, but as a green economic stimulus. This has the added advantage of supporting global democracy. It's a lot better for the domestic economy and for global democracy if we spend our energy dollars internally on solar power and wind power and energy efficiency, than if we give those dollars to the world's various and multiple petrostate dictatorships.

But this plan might call for more, not less fiscal stimulus, especially if the economic model used required a lot of government intervention to set up the correct market conditions. It might even add to the deficit, at least in the short term.

If you put me in charge of the US government, I'd probably run up the deficit over several years to pay for some serious energy research and a lot of renewable energy and energy efficiency measures, all to prevent climate change!

I'd be careful not to run it up more than we could afford to pay for on the proceeds of the very large domestic energy and reconstruction boom we would then have.

But I'd run it up nevertheless.

Of course, this idea is a non-starter too, at least without a major change in US politics.

One other notion that received at least some bipartisan support a while back, even (for a very short while) from the irrepressible deficit scold himself, Grover Norquist, is that we might reduce climate emissions in a deficit-neutral manner by using a carbon tax to switch incentives around within the economy, to reduce the amount of government investment needed by using private money in response to market-based incentives.

Tax fossil fuels, subsidize renewables and efficiency.

You could, if you were really clever, even use the carbon tax to begin to pay down the debt.

Now there's a thought. Two birds with one stone.

Of course, thinking complex thoughts like this about the climate crisis and the American electorate requires a considerable amount of economic and political science education. And not just about ordinary or mainstream economics. Young people should be given the facts about climate change, as well as an education in these three competing economic models, and then even asked to evaluate a Dalian zero growth or steady-state model against this green Keynesian model.

We cover all this in our Unity College economics classes, and even in our required Core III Environmental Sustainability class.

I do believe, though, that my own sophistication about these ideas has probably grown since this particular student was in any of my classes.

I certainly I don't expect we'll get there on Facebook.

No comments:

Post a Comment